Being to live in a modern world, one of the most advantages is to go cashless. And this is only possible for One card credit cards. From shopping for groceries to buying a car, everything is possible with a One card credit card. When talking about credit cards, one of the most reliable cards is the One card credit card. It comes with a ton of benefits and offers.

One card credit card is India’s one of the best metal credit cards. Which offers full transparency, giving back control to all its customers. Let’s check out everything which you want to know about One card credit card before applying for it.

Eligibility criteria for One card credit card

To apply for One card credit card, there are some criteria that you need to check before applying for credit card. Here in the following are the criteria that you need to know

- To apply for One card credit card, your age must be in between 18-60 years.

- Below 18 years of age, people are not eligible to apply for One card credit card.

- Self-employed persona and salaried individuals can apply for One card credit card.

- Cardholder need to have a stable income to apply for this credit card.

- CIBIL score of the individual needs to be above 750.

Required documents

Documents required for One card credit card are

- PAN card photocopy

- Income proof photocopy

Resident’s proof like :

- Voter ID

- Driving licence

- ADHAAR card

- Passport

- Electricity bill

The above list is indicative, it may vary person to person.

Collaborated Banks with One card credit card

Let’s see, which are the five banks that collaborated with One card credit card. You can also easily apply for your One card credit card from any of these five banks.

- Federal bank

- Bank of Baroda Financial

- IDFC First Bank

- South Indian Bank

- SBM Bank

Check New Card : Axis Bank Credit CardHow to apply for One card credit card

Applying for One card credit card is a smooth and easy process, there is nothing complicated in it. You can apply for your One card credit card from any of its collaborated banks. Just go to any of the bank net banking site. Open the page.

There you can see apply option for One card credit card. Click on the option and put all the details they ask for. And within a few days your card will be created and issue. So you see, there are so many options for applying this credit card.

How long it takes to get a One card credit card

Generally, this is one of the fastest delivered credit card. It takes almost 3-5 days or less after apply for One card credit cards. Within these 3-5 days, the card will be delivered to its customers.

Your Quiz Is Started From Here

- Q2

How to check One card credit card application status

To check the status of your one card credit card status, you can do it in two ways, online and offline. In online, there are many options available here. Such as,

- after applying for the credit card, you get an application ID to track the status of your card.

- You can check your card status in your mobile by sending a message in their contact number.

- Then they ask for the application ID and after given it you can check the status.

Or,

Next, by using your email, you can check your status.

- Write a mail in a simple language added all the details like application ID, PAN number and many more and then send the mail.

- You get an email within few minutes

- And see the status of your card.

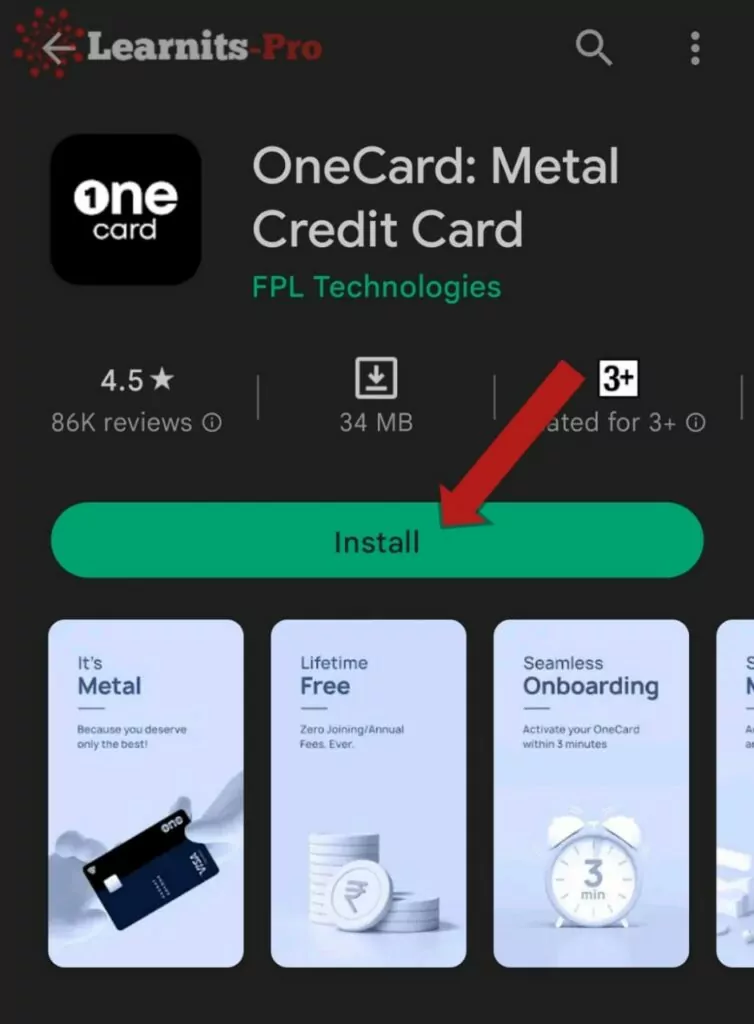

Or. by using the most powerful app by One card credit card. Install the app of One card credit card.

- Go to the One card credit app

- Click on the status option to get to know your one card credit card status

- And get all the information you are looking for.

How to log in to One card credit card

Log in to your One card credit card is very easy, lets checked out

- Open the One card credit card

- Open one of the most powerful app for One card.

- Go to setup option in the screen

- Added your registered mobile number.

- Then an OTP will be sent to your registered mobile number

- Now set up a PIN for security. The PIN must be chosen as per it ask you to make.

- And now you are all set and log in to your One card credit card put your registered mobile number and PIN and the process is completed.

Fees and charges of One card credit card

One of the most important and unique benefits of One card credit is that it comes with no fees or any other such charges as long as you use your credit limit and pay the full outstanding within the due date.

But in case you go over the limit or delay in payment or part payments, some charges may occur. Let’s check out the charges in these cases:

- If you applied for One card metal credit card then you need to give an issuance fee of Rs. 3000.

- For 2nd re-issuance on One card plastic credit card, you need to pay Rs. 145.

- For 3rd re-issuance on One card plastic card, you need to pay Rs. 500.

- The One card’s metal credit card there is a re-issuance fee of Rs.5000 that needs to give.

- Card cancellation charge for Primary cardholder of One card plastic credit card is Rs.500

- For primary cardholder of One card metal credit card the cancellation charge is Rs.3000.

- For Add-on cardholder’s of One card plastic credit card, cancellation charge is Rs.500.

- ATM withdrawal fees for one card credit card is 2.5% of withdrawal amount and minimum withdrawal amount is Rs.300.

- Forex Makeup fee of One card credit card is 1%.

- Over limit fee of One card credit card is 2.5% of the total over limit amount.

- Interest fee for 48 days is 3% per month and 36% for annual basis.

Please note that apart from these above charges and fees, there is an additional GST will be added as per rules of Government of India.

Benefits of One card credit card

One card credit card offers many attractive offers and discount to their customers, which you never want to miss out. So here are the benefits or you can say offers and discounts which you can get along with your One card credit card.

- There is no joining fees for applying for One card credit card.

- There is no such annual fees will charge in One card credit card.

- No rewards’ redemption fees and charges are deducted in One Card credit card.

- You can easily connect or do any changes with its mobile app

- This is the only credit card in India which offers a Metal credit card

- You can easily issue a digital boarding pass with One card credit cards

- One card credit card offers 5 times more rewards on your top spends

- Rewards point directly credited to account.

- You can redeem point by just one swipe.

- Easy EMI option along with part payment option is also available on EMI.

- EMI’s comes with good rewards.

- Easily manage your EMI from EMI dashboard

- Another best use of your One card credit card is you can share your One card credit card with your family.

- Get up to 50% off on foods and dinning with your One Card credit card.

- Up to 15% off on shopping in One card credit card.

- Get up to 10% off on electronic appliances.

How to generate PIN of One card credit card

One card credit card features with one of the most powerful app, so generating PIN in your credit card is very easy, look out the following steps to get all the information about how can you generate PIN,

- After getting your credit card, go to any of your nearest collaborated bank ATM.

- Choose the language as per your choice

- Then go to ‘create PIN using OTP’ option.

- After that, an OTP will be sent to your registered mobile number for authorization.

- Now put the OTP to the ATM

- Then you need to type a 4 digit PIN as per your choice.

- Re-enter the PIN and click on the submit option below the page

- Then your new credit card PIN is generated, and a message will send by the bank after completion of the whole process to let you know.

If you want to change your PIN, you need to follow the same procedure as above.

FAQs :

Is OneCard a credit card?

What are the benefits of OneCard?

2. There is no such annual fees will charge in One card credit card.

3. Rewards point directly credited to account.

More benefits mention in above headings.

Is OneCard RBI approved?

Is OneCard trusted?

Is having just one credit card good?

Conclusion :

To apply for the One card credit card, the first bank that issued this card is IDFC FIRST Bank. Apart from it is India’s first metal credit card, it offers its customers a ton of offers. That definitely attract you, and with your One card credit card you can go cashless anywhere without any hassle, you do not need to think more.

Also, collaboration with many leading banks of India is undoubtedly made this card stand out from other credit cards. Meanwhile, resident of India and non-resident both can apply for this card and get all the offers equally. So I hope this article will help you to know all the details about One card credit card. And you do not need to go anywhere else for anything.